A Data Drive.

A warm welcome from Fruit Capital Management Services HQ. With the conclusion of Q2 2021, June saw the unfolding of some of the most important events with respect to the cryptocurrency ecosystem.

The Good:

-

First time in history that country has now officially moved the parliament to adopt Bitcoin as legal tender. 62 out of 84 votes in favour of the move.

-

Bank Of Israel to build Digital Shekel on Ethereum.

-

Goldman Sachs, Citibank, State Street, BBVA Spain, Ark Invest make significant inroads to drive up crypto adoption.

-

Crypto investing thrown open to 4000 German Investment firms, up to 20% exposure permitted.

-

The Bitcoin mining Industry’s sustainable energy mix reaches 56% in Q2, up 52% from a low 36% in Q1.

The Bad:

-

China bans BTC mining leading to exodus and widespread panic across the market, BTC hash rate plummets to levels last seen in May 2020.

-

Africrypt, a South African CEX rugpulls $3.6B worth of member’s funds.

-

$2B lost in Iron finance bank run.

-

$250K Defi exploit on the Safedollar protocol, an algorithmic stable coin on Polygon.

-

Binance suspends operations in Ontario, forced to comply following regulatory heat across the world (UK, Japan, Singapore).

The China hurdle:

June 2021 saw the most decisive and targeted Sovereign attack on the lightning network. With the arrival of the 100th anniversary of the CCP, China banned all Bitcoin mining within its borders.

BTC’s hash rate fell to 94 EH/s as miners scrambled to relocate operations. With a temporary decline in Hash rates, the electrical floor cost price for BTC has reduced. Historically, the price of Bitcoin has never breached its mean electrical cost price. This also meant that we saw the largest drawdown of the Bitcoin network’s Difficulty adjustment on the 26th of June: roughly 27%. What are the implications? Bitcoin was designed to be resilient, blocks are now 27% easier to mine than the pre-China ban.

Source: cryptothis.com

Smaller miners will be more profitable until eventually all the nodes that went offline relocate to crypto-friendly nations. Previously, China was behind 70% of all Bitcoin being mined. This narrative of China having majority control over Bitcoin’s hash rate is now buried. The move ensures better decentralization of BTC nodes across the world. A large-scale exodus of miners to Kazakhstan, Europe, and North America is underway. In a country where Facebook, WhatsApp, Google, Netflix, Twitter, Reddit, Skype, Pinterest, Medium, Quora, and just about everything else is banned- this was Bitcoin’s right of passage. The redeployment of nodes in the aforementioned locations also means better access to clean energy, this could not be more bullish for the lightning network in the long run.

What are some of the key metrics for Bitcoin telling us?

As this article is being written, Bitcoin is changing hands at $34,138.

Relative Strength Index:

MFI, W.

Zooming out, one can see that the RSI has been following a beautiful structure since 2018. BTC was heavily overbought, the drop from $64K to $28K fixed that. The market is back to being at healthy levels. This mirrors what we had written about last month- we are in an accumulation phase, look for a bounce at the 40–45 level in Q4,2021.

Money flow index:

MFI, W.

The MFI hasn’t closed this low since October 2019. Sitting at 29.17, this is in line with the general sentiment of the market. For long-term investors, you don’t want to be putting in any lump sum buys when everybody is jumping in.

ADX & DI:

Average Directional Movement Index & Directional Indicator.

On the daily, we can see the strength of the bears peaked on the 2nd of June, gradually decreasing ever since

Pi-cycle Top:

Pi-Cycle BTC, D.

The Pi-cycle top indicator crossed while we were at $53,330, a clear indicator that the local top was in. Immediately after, we had our first capitulation event to $30,500.

Hash Ribbons:

Hash Ribbons, W.

The elusive Hash ribbons indicator which historically has always worked out well post its buy signals is yet to print a blue circle. Estimation of the printing of the next buy sign from a simple extrapolation gives 8th August as the potential date.

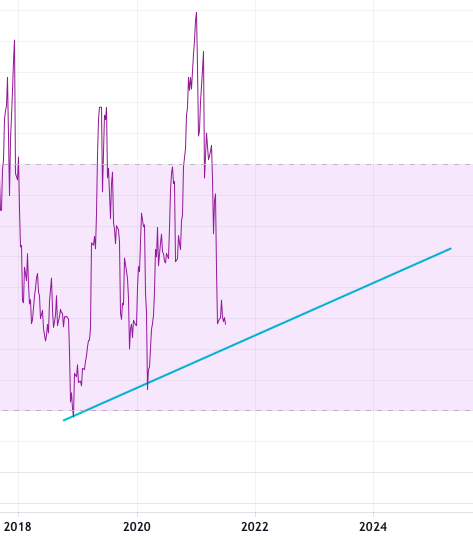

S2F Model:

Stock to flow model

With a slight lag forming in the stock to flow model, we shall see a run back up to synchronize with the stock to flow levels post this bull market consolidation.

200 Week Moving Average Heat Map

200 WMA Heat Map

As the market cools, this gives us all the more reason to scale in extra buys. Red and orange dots signify a good time to start scaling back buys, with blue and purple dots Historically being a great time to step up investments.

Stochastic RSI:

Stochastic RSI, Weekly.

As the stoRSI bottoms, this will eventually become incredibly bullish for BTC and the market as it starts to pick up steam. We now wait for a clear cross with strong upward momentum signaling the start of the next bullish leg.

Reserve Risk:

Bitcoin Reserve Risk

The red zone signifies an unattractive risk/reward ratio for investors with green signifying a golden opportunity to start accumulating excess BTC. With a significant cool-off post-BTC’s previous ATH, the current risk/reward ratio for long-term hodlers is very favourable.

Closing thoughts:

Post our previous BTC ATH, the retail FOMO was quelled as roughly $2.5B was sold. Negative news from China sparked heavy selling that led to BTC hitting the $28,500 level. As we approach the end of this week, a volatile weekend is expected with the impending unbonding of almost $5B in GBTC that may create additional selling pressure.

Bitcoin continues to be in a quiet accumulation phase. Smart money isn’t interested in catching a falling knife, the meat of every move is where they make their best investments. The next five months should make the eventual bottom for this accumulation phase very clear. There is a possibility that we have found that bottom at $28.5K. $30K to $40K continues to be a very attractive zone to accumulate. Those that scale into good projects will see their forays into the asset class rewarded handsomely post this accumulation phase.

When you choose to invest with Fruit Capital, we do all the heavy lifting. You Invest directly into the markets and leverage actionable insights generated by our in-house research team. Kick back and relax while our strategies make you money. Have your crypto portfolio managed professionally now by subscribing to our cryptocurrency advisory service.

-Fruit Capital,

Cryptocurrency Advisory Service.