The Complete Guide to Bitcoin Wealth Management for High-Net-Worth Investors 2025

The New Paradigm of Crypto Wealth Management

The landscape of wealth management is being revolutionized by blockchain technology and digital assets. High-net-worth (HNW) individuals and family offices are increasingly considering strategic allocation to Bitcoin and cryptocurrencies to diversify, preserve, and grow intergenerational wealth in 2025. But managing crypto assets at scale demands an advanced, multidisciplinary approach that spans portfolio design, tax strategy, estate planning, and robust security.

Why Bitcoin and Crypto Portfolios for HNW Individuals?

-

Store of Value: Bitcoin's fixed supply of 21 million coins offers a compelling hedge against fiat currency devaluation and inflation concerns.

-

Portfolio Diversification: Leading reports show HNW and ultra-HNW individuals are allocating up to 9% of their portfolio to crypto, seeking uncorrelated returns compared to traditional asset classes.

-

Institutional Adoption: The launch of Bitcoin ETFs and ETPs and improvements in custody solutions make allocation safer and more efficient for sophisticated investors.

How Much Should You Allocate to Crypto?

-

Conservative Approach: 3-5% of total assets, focused on Bitcoin and Ethereum, is common among private wealth managers.

-

Growth-Oriented Strategy: Younger investors and family offices sometimes place up to 9-12% in digital assets, expanding into carefully researched altcoins and DeFi products.

-

Practical Example: For a $10M net worth, this would mean an allocation of $300,000-$1.2M in digital assets, tailored to personal risk tolerance and investment horizon.

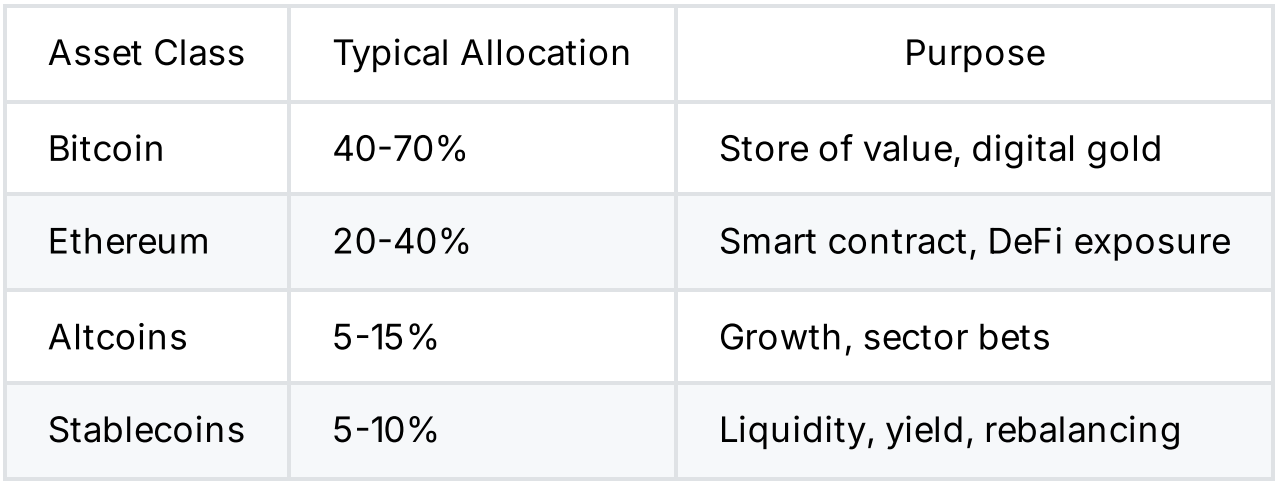

Building a Sophisticated Crypto Portfolio

Diversification Matters

-

Core Holdings: Bitcoin (BTC) as a store of value. Ethereum (ETH) for exposure to smart contracts, DeFi, and Web3 innovation.

-

Opportunistic Buckets: Carefully vetted altcoins, staking, and crypto funds for potential alpha.

-

Rebalancing: Review and adjust allocations regularly in response to gains, volatility, and market developments.

Bitcoin Inheritance and Crypto Estate Planning

As digital assets grow in value, proper inheritance planning is critical.

-

Probate Concerns: If Bitcoin and other cryptocurrencies are not included in a will or trust, heirs may face delays, extra costs, or even inaccessible assets.

-

Trusts: Establishing revocable living trusts or digital asset trusts protects privacy, enables smooth transfer, and mitigates risk of loss or theft.

-

Key Management: Maintain a secure, up-to-date list of digital wallet access instructions for executors and beneficiaries. Consider professional trustees or digital asset vault services.

-

Jurisdictional Differences: Inheritance tax on Bitcoin may apply in some jurisdictions; consult local law and tax professionals.

Crypto Taxation: What HNW Investors Must Know in 2025

Taxation of Crypto Gains

-

Flat 30% Tax Rate: In India and many jurisdictions, gains from crypto sales are taxed at 30%, with no deduction allowed except for the acquisition cost. Losses can neither be set off against other income nor carried forward.

-

TDS Provisions: A 1% tax deduction at source (TDS) applies on sale proceeds of virtual digital assets.

-

Greater Compliance: Budget 2025 expands the definition of virtual digital assets and mandates increased reporting by exchanges and intermediaries.

Tax Optimization Strategies

-

Long-term Holding: Minimize tax events by reducing unnecessary trades.

-

Tax-Loss Harvesting: Offset gains by realizing losses in eligible jurisdictions (not all allow this for crypto).

-

Trust and Estate Planning: Use trusts to potentially optimize tax and ensure intergenerational transfer efficiencies.

Security and Custody Solutions

-

Multi-Signature Wallets: Protect against single points of failure by requiring multiple approvals for transactions.

-

Cold Storage: Store large balances in offline hardware wallets or institutional-grade custody solutions.

-

Insurance: Evaluate providers who insure digital assets against theft or hacking incidents.

-

Regular Audits: Periodically review wallet security and update contingency plans.

Conclusion: Professional Crypto Wealth Management Is Essential

For HNW and ultra-HNW families, the future of wealth management is crypto-native, compliant, and customized. Combining forward-thinking asset allocation, bulletproof estate planning, rigorous tax compliance, and top-tier custody forms the backbone of generational crypto wealth preservation.

Action Items for HNW Investors

-

Conduct a portfolio review and determine your optimal crypto allocation.

-

Work with specialized advisors to integrate crypto into your wealth and estate plan.

-

Set up proper security, reporting, and inheritance protocols.

-

Stay informed on evolving regulations and best practices.

Ready to Secure Your Crypto Legacy?

Fruit Capital Group specializes in boutique crypto wealth management, inheritance planning, tax optimization, and bespoke portfolio strategies for HNW individuals and family offices. Contact us for tailored crypto wealth solutions.

-Fruit Capital,

Your crypto experts.